Budgeting Tips for Renters

This post, "Budgeting Tips for Renters," was originally published on the Apartments.com Renterverse in 2023.

According to the US Bureau of Labor Statistics, Americans are spending almost 35 percent of their total income on rent. The average renter is spending $5,111 per month on rent at a time when other costs are also rising, including food, healthcare, and education. It makes having a budget and sticking to it more important (and more difficult) than ever. If you’re thinking about revising or creating a budget to help keep you on track, here’s how to get started.

What is a budget?

A budget is like a roadmap that outlines your income and expenses. To get you where you want to go, a budget will help you determine what you are spending so you can find places where you can save. In short, a budget helps you manage your money.

Budgets can be simple (such as a log of income and expenses scribbled in a notebook) or complicated (such as those created by large companies and government entities). There are different types of budgets. Here are a few:

Surplus budget

A surplus budget means you’ll have money left over after paying all your expenses. You could put this surplus into savings and build on it over time.

Balanced budget

A balanced budget means you earn exactly enough to cover your expenses — no more and no less. After all your expenses are paid, you are zeroed out. In this case, you wouldn’t have money left over to put into savings.

Deficit budget

A deficit budget means your income isn’t enough to cover your expenses. To cover the gap between income and expenses, you might find yourself skipping payments, using credit, or taking out loans.

Why you need a budget

A budget is a visual outline of your financial situation that will give you clarity on where your money is going. Seeing it “on paper” will assist you in coming up with a plan. For example, if you’d like to save for a cross-country move or a larger apartment, a budget will help you achieve both your short-term and long-term financial goals.

Being able to see where you’re spending your money will show you ways to cut costs so you can stay on track. If you know you only have so much to spend on “extras” every month, you’ll be much more careful about making impulse purchases.

According to Experion, the average American has a credit card debt of $5,589. According to the Federal Reserve Bank of New York, credit card debt has been steadily increasing since 2019. Today, it’s about $2.36 trillion higher than it was at the end of 2019. With interest rates rising, now is a good time to rethink how you’re using your credit cards.

Different budgeting methods

Depending on your financial goals, there are several different ways to structure your budget. Here are a few to consider.

50/30/20 budgeting

To create a 50/30/20 budget, write down your net income. Your net income is your take-home pay, the amount after taxes and deductions. This is different from your gross income, which is the amount before taxes and deductions are taken out.

Using your net income as your baseline, divide it up into needs, wants, and savings. Your needs bucket is largest at 50 percent of your net income. This bucket covers rent, utilities, groceries, insurance, credit card payments, car loans, medications, and any other necessary bills you have.

Under wants, list the things you typically spend on hobbies, entertainment, and shopping. These aren’t extravagant purchases like trips. This bucket is for the things you buy or pay for that aren’t absolutely necessary. For example, if you live in a cold climate, you need a coat. But if you decide you want several coats or you choose the expensive designer coat over the cheaper one, that’s a want.

The “wants” bucket should also include bills that you don’t need, but being without them might be slightly inconvenient, such as subscription services. This is the second largest chunk of your pay at 30 percent. The remaining 20 percent will go into savings.

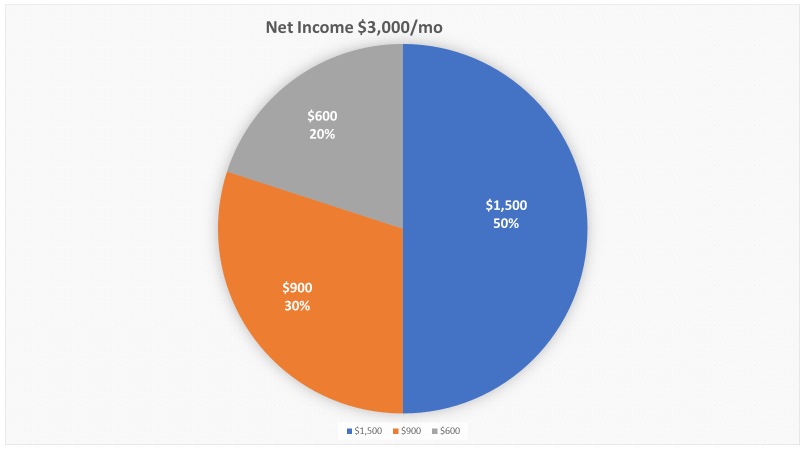

Here’s an example of how a 50/30/20 budget might look:

If your monthly income is $3,000, then $1,500 (50 percent) would be set aside for necessities. Another $900 would go toward wants, and the final $600 would go into savings.

A line item budget

A favorite of offices everywhere, a line item budget shows you individual expenses and how much is budgeted for those expenses. In businesses, this is usually done by department. Your line item budget would be far simpler. This budget can show you exactly where your money is going each month. If you aren’t sure whether something is a need or a want, this might be a better system for you than the 50/30/20 budget.

Again, start with your net income. Write that at the top of your sheet, then list every expense you pay in a month, followed by the amount you pay each month. If you pay something quarterly, divide it into monthly payments so you can keep track of these payments in your budget. This budget might look something like this:

| Expense: | Monthly Income: $3,000 |

|---|---|

| Rent | -$1,500 |

| Electric Bill | -$50 |

| Water Bill | -$30 |

| Car Payment | -$300 |

| Renters Insurance | -$25 |

| Wi-Fi | -$75 |

| Gas Bill | -$40 |

| Credit Card | -$100 |

| Groceries | -$150 |

For this budget, you can write it out on a sheet of notebook paper or use a spreadsheet. If you have many bills, you might want to break this down further into categories, such as utilities, insurance payments, and credit cards.

Deduct each one of the bill amounts (even the quarterly ones) from your income. Split the leftover amount into savings and discretionary (this can be for entertainment, for a bill that is more than expected, or for emergencies like a doctor’s visit). After deciding how much you’ll need for discretionary purposes, put whatever is left in savings.

In the example above, there’s $730 left after the monthly bills are deducted. If you divide this amount in half, you would put $365 in savings and keep the rest as discretionary spending money for the month.

Envelope budgeting

If you need a budgeting method that’s a little more tactile, envelope budgeting might appeal to you. In this scenario, you’ll want cash and several envelopes. Have an envelope for every expense, including rent, gas and auto needs, personal care, utilities, insurance, etc.

You’ll label each envelope with an expense, such as “groceries.” Figure out how much you spend every month on groceries, and break that up according to your paychecks. For example, if you spend $200 a month on groceries and you get paid weekly, you would take $50 from each paycheck and put it in your “groceries” envelope. If you get paid twice a month, you would put $100 from each check in the envelope. When you go to the store, you would take the cash out of the envelope and only spend that amount.

This method works best for those who tend to overspend in a certain area. For example, if you enjoy frequenting coffee shops, you would determine how much you can afford to spend each month and set that money aside in an envelope. When the money is gone, you must wait for the envelope to fill back up before you can visit again.

Pay-yourself-first budget

The pay-yourself-first budget is a reverse of the above. Instead of deducting your bills and then taking what is left over to put into savings, you put money into savings first. This method takes some planning and strategy because you don’t want to pay yourself and then not have enough money to cover your rent or utilities.

First, review your spending habits. Look over your past few months’ bank statements to see how much you typically spend every month. Add a little to that amount to make sure you keep enough available to cover expenses. The rest will go directly into your savings. As soon as you get your paycheck, you will transfer that amount into savings and ignore it.

This method is far less time-consuming since you don’t have to spend time doing the math on a spreadsheet, but it is also trickier than other methods. You may find that you didn’t budget enough for certain expenses. Or, if you have a lot of credit card debt and only budgeted the minimum payment, the interest may keep you in debt longer than if you had set aside more for credit card payments.

Zero-based budgeting

Zero-based budgeting is very much like line item budgeting, only there isn’t anything left over. With this budget, you account for every single penny. This will take some planning. Start by tracking everything you spend for a few months. This includes stops at the gas station, groceries, ordering takeout, and so on.

You can lump some of these expenses together to make this budget easier. For example, “entertainment” might cover dining out, movies, and video games. Determine how much you’ll put into savings and add that to your spreadsheet, as well. Everything should have a line in this budget, from what you’ll spend at the grocery store to the hair salon. The goal is to allocate every bit of your income to something, zeroing out at the end of every month.

This method is detailed and time-consuming, but it might help you keep better track of what you are spending and where.

The 60 percent solution

If maintaining spreadsheets and tracking expenses just seems like too much effort, the 60 percent solution doesn’t require any of that. In this budget, you basically set aside 60 percent of your monthly income for everything you feel is a necessity. It could include rent, utilities, and other bills. It could also include things you feel are necessary, like your gym membership or your monthly subscription service.

The other 40 percent is divided up into smaller increments and set aside for special purposes. This could go toward savings, a vacation fund, an investment account, a retirement account, and so on.

How to be a budget planner

You’re more likely to stick to your budget if you set some goals. Decide what you want to accomplish and keep that goal in mind, whether it is paying off your student debt or buying a house.

If you review your budget and find you are in a deficit situation, try to find ways to eliminate some expenses. If rent is consuming more than 30 percent of your income, consider finding an apartment in a more affordable neighborhood or maybe even finding a roommate. Cut back where possible. For example, taking your lunch to work instead of buying lunch could save $200 a month (if you spend $10 a day, five days a week). Make your coffee at home and avoid the drive-through coffee shop.

Be consistent when tracking your expenses, but don’t be too strict with yourself. No matter which budgeting method you choose, make sure you give yourself a spending allowance for small luxuries, even if it’s just dinner with friends once a month. If you set too strict of a budget, it will be difficult to stick to it.

Hopefully, these tips will help you create a budget and save money. The more you can save now, the better off you’ll be in the future.

Published February 6, 2023

ABOUT THE AUTHOR

Alecia Pirulis

For more than 14 years, I've been helping renters find their perfect home. As part of a military family, I grew up in a variety of rentals, from apartments and houses to duplexes and condos, so I understand and appreciate what renters face when trying to find a new home. When I'm not writing, I enjoy spending time with my two sons, playing video games, and reading British mystery novels.